Overview

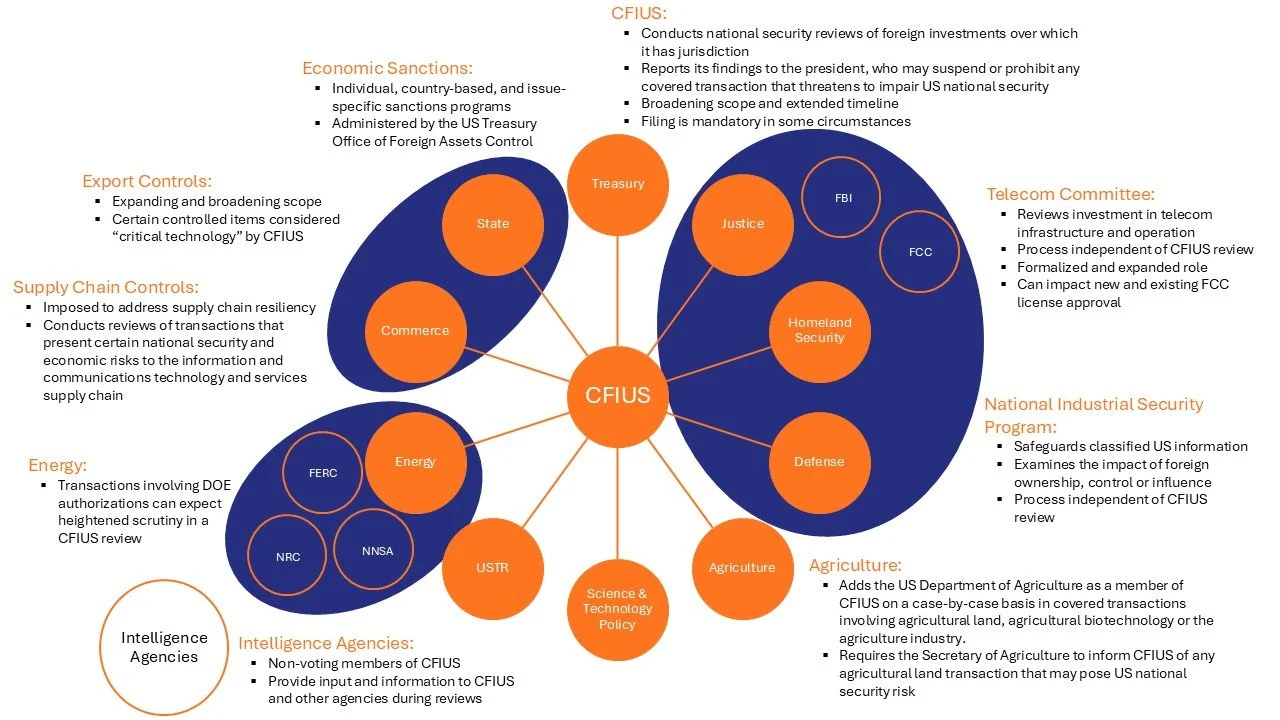

The reach and authority of the US government over what it considers to be national security concerns is broad, increasing and often not subject to judicial appeal. In response to mounting threats to the personal, economic and national security of Americans—real or perceived—the US government has implemented, expanded or co-opted extensive regulatory frameworks to protect US national security. This includes reviews of transactions and investments by the Committee on Foreign Investment in the United States (CFIUS) and the Committee for the Assessment of Foreign Participation in the United States Telecommunications Services Sector, the application of export and supply chain controls by the US Departments of Commerce and State and oversight of the National Industrial Security Program by the US Department of Defense, as well as myriad other licensing and authorizations related to energy, transportation and financial services businesses.

Although these various regimes have evolved separately in response to different potential national security threats, both Congress and the US executive branch have recognized their interplay and their potential as policy tools. In recent years, Congress has overhauled the CFIUS process and solidified the committee’s connection to US export control laws in an effort to further limit foreign access to US cutting-edge technologies, while the executive branch continues to patch perceived national security gaps in US technological leadership and supply chain security and resiliency by empowering agencies to limit or prohibit commercial transactions as perceived necessary.

In this increasingly challenging regulatory environment, foreign investments in US companies in a wide range of sectors are likely to encounter one or more of these regulatory regimes in a single transaction. It is critical for transaction parties to understand the potential hurdles before investing their time, capital and reputation so that they can better navigate the regulatory quagmire. While these legal processes can work in parallel, they often have different deadlines and are implemented under different laws, complicating timing and closing decisions. Some require formal notice of a foreign investment months in advance and others can result in severe limitations on the governance rights of foreign investors or on their access to US-origin technology.